You can withdraw money from your PF account to buy a home even if it is being registered solely in the name of your spouse or jointly in your and your spouses name. Process to Withdraw EPF.

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

For housing loan repayment for a house owned by you.

. House purchase or construction If you have been in service for 5 years you are free to withdraw up to 3 years of your monthly pay along with the Dearness Allowance for the purchasing or. The withdrawal sum will be pulled back from the EPF account and will be deposited into the. EPF Form 31 is used to make declaration for partial.

You can withdraw 75 of your EPF after one month of unemployment. Other than that the amount can be withdrawn only in the case of emergencies such as Medical emergency House loan repayment. Check how to withdraw EPF online.

You can also withdraw money for funding the construction of your house. The waiting period is 2 months. For land purchase an amount of up to 24 times of an individuals monthly wages and dearness allowance can be withdrawn.

Land purchases construction or the purchase of a new house. To withdraw funds from their EPF individuals can choose to follow either one of the following. 90 can be withdrawn at the age of 57 years.

Mr Z can withdraw Rs 75000 as non-refundable. Know about withdrawal Form documents required benefits taxation and other details of PF withdrawal. In case you need to withdraw you will have to fill out a declaration with a specified reason for the same.

The labour ministry has announced that EPF members can now withdraw twice from their EPF account to meet the emergency expenses arising due to the Coronavirus pandemic. EPFO allows members to withdraw money from EPF Account twice to meet COVID-19 Emergency. You can withdraw money from your EPF account at the time of retirement and after attaining the age of 55 years.

Declaration in Form 31. You can partially withdraw your PF for purposes such as construction of a new house. At least 5 years of contribution to the PF account is a must to withdraw PF money for house purchase.

The maximum that one may withdraw from the PF account is 36 months basic wages or the total of employee and employer share with interest or total cost whichever is least. These include a childs education wedding purchasingconstructing a house. Here Mr Z can withdraw lower of the below amounts.

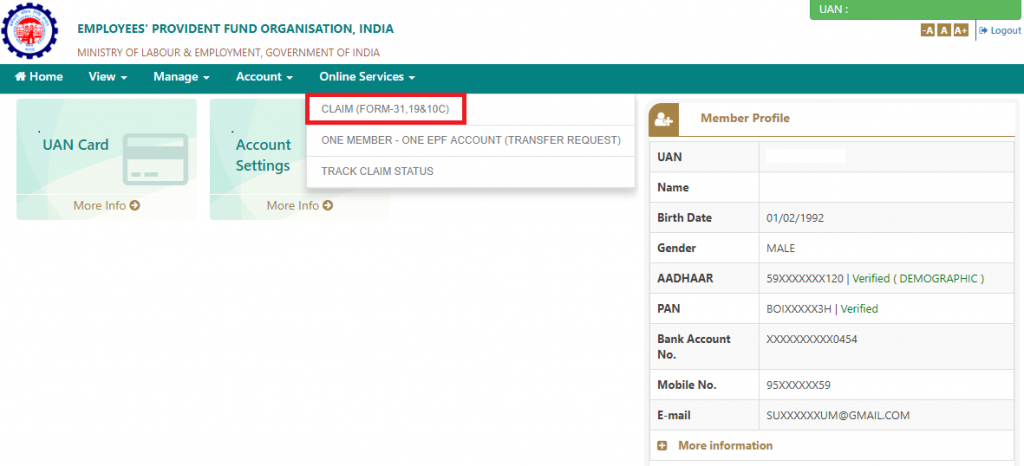

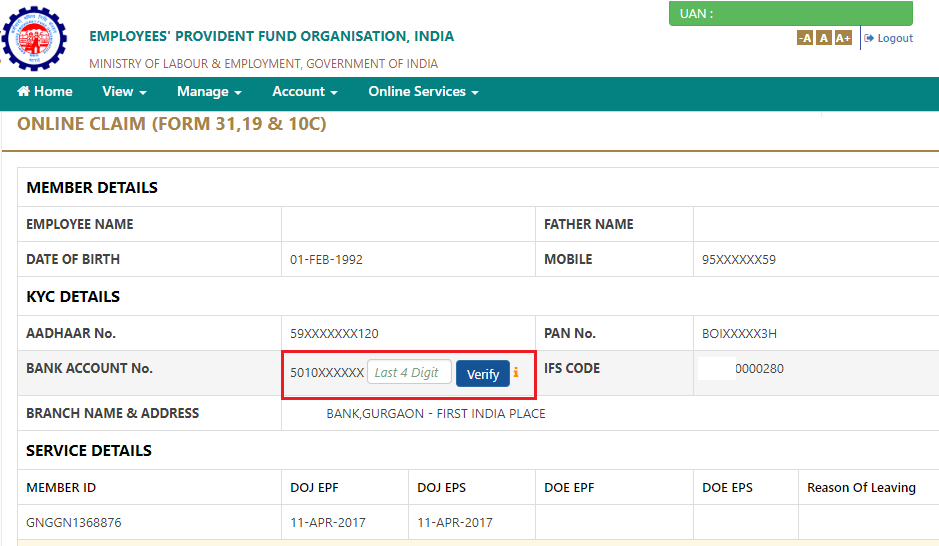

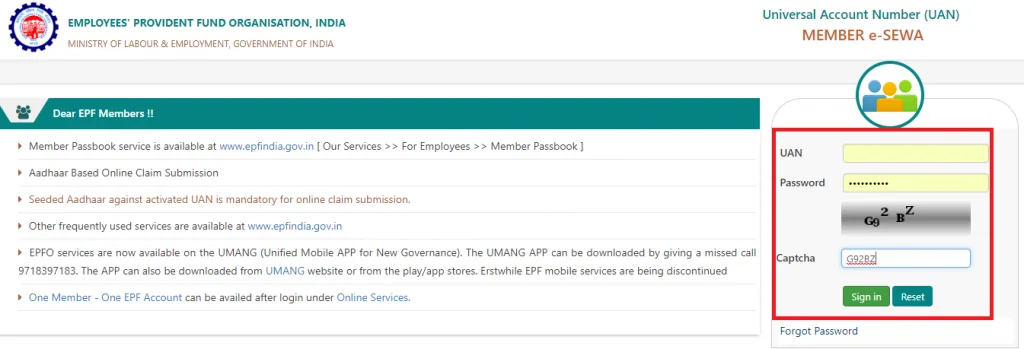

Employees seeking an advance can make an online application using their login on the EPFOs website. Existing rules for house purchase As per the existing rules for the purpose of purchase of a house from a promoter Builder membership period required is minimum 5 Years. EPF India members can withdraw EPF by submitting a withdrawal application either offline or through EPF online portal.

You can repay home loan EMI from EPF. For constructing a house 36 months of the basic salary including dearness allowance 12 times of monthly salary. Purchase or construction of the house.

All about PF balance check with UAN number. Withdrawal from Account 2 to purchase a PR1MA house. Employee must have completed at least 5 years of continuous service from the date of completion of construction of the house.

From 12th April 2017 EPF withdrawal for house flat or construction of property is availed up to 90 of the balance. Before you move on to the process to withdraw EPF you must ensure that your UAN is activated and is linked with your KYC Aadhaar and PAN Card details. Individuals need to fill up a new composite claim form or a composite claim form and submit the same to the EPFO office under their jurisdiction.

Market-linked returns may seem attractive but on the flipside maximum lump-sum withdrawal of 60 percent. An individual can withdraw his PF amount either online or offline and also can opt to withdraw the amount either fully or partially. The withdrawal conditions are.

You can withdraw 100 money from the EPF and EPS account at the time of retirement 58 years of age. You can withdraw money from your PF account if you are buying a house or a piece of land to build a house. Each member or employee shall nominate a person in the declaration Epf Form-2 Withdrawal or EPF Withdrawal form conferring the right to the nominated person to receive the benefitamount in case of the death of the member or employee.

List of Epf Withdrawal Form like 5 9 10-c 10-d 13 14 19 etc available at epfindia official website. Rs 75000 75 of Rs 100000. The employee has to manually fill his details in the form while applying offline whereas if the employee applies online most of hisher details will be auto-filledHowever the member has to register his UAN to avail the online service.

You can withdraw your EPF amount any time and whenever you need treatment. 75 of the balance standing in the members account. Advance for purchase of houseflat construction of house including acquisition of site EPFO allows its members to withdraw up to 24 months of basic wages and DA for purchase of land.

These are discussed below Individuals willing to withdraw EPF for marriage purposes can do so only 3 times. Is NPS a better alternative to EPF after tax on interest on contribution over Rs 25 lakh. The employee can withdraw an amount equal to 12 times the.

Financial strength is. The provision to withdraw money from EPF accounts was first announced in March 2020 under the Pradhan Mantri Garib Kalyan Yojana PMGKY According to the withdrawal rules EPFO members can take non-refundable withdrawals of up to three months basic earnings and dearness allowance or 75 percent of the EPF account balance whichever is smaller. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

The Procedure of filing for withdrawal through EPF Form 31. As per the latest EPF Withdrawal rules you can withdraw money from your EPF account only if you have no job at the time you apply for withdrawal. You should have completed a minimum of 5 years in service.

EPF Form 31 can be filled online as well as offline. The maximum amount that is allowed to be withdrawn is either the total employees share or six times of wages whichever is lower in value. News Update 1 st June 2021.

For examplebalance in EPF account stands at Rs 1 lakh. Individuals withdrawing EPF to purchase a plot or house or construct a house can apply for a one-time EPF advance claim. Withdrawal from Account 2 to.

Advance EPF withdrawals are permitted under certain circumstances and have specific limitations.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

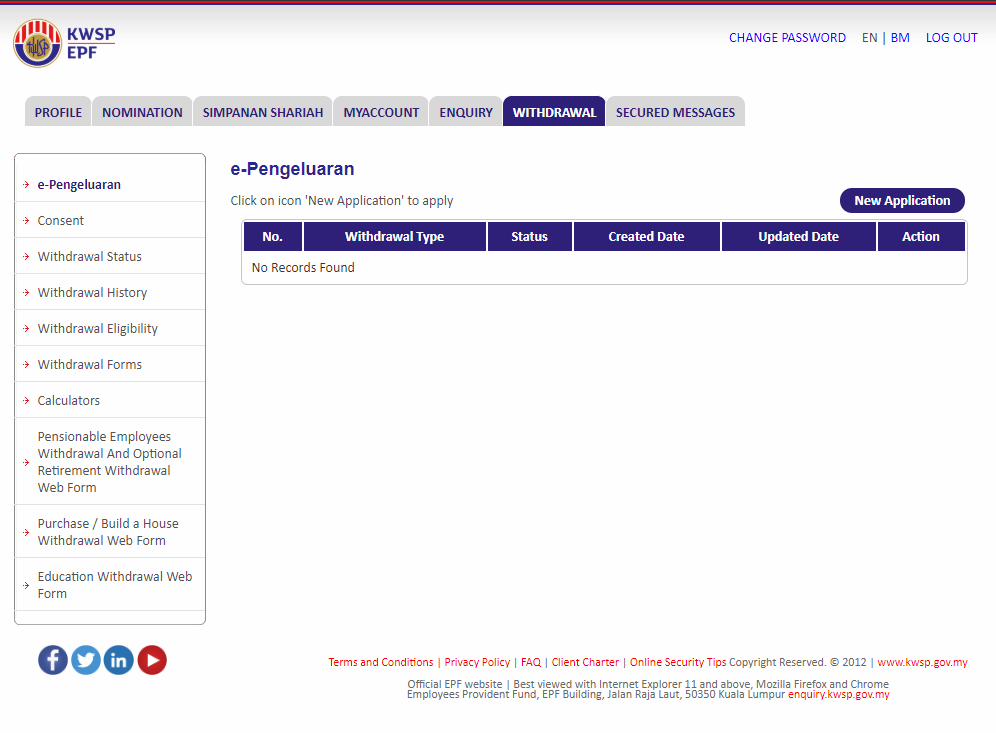

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

How To Withdraw Epf And Eps Online Basunivesh

Pf Withdrawal Process Online 2021 Pf Advance Limit And How Many Times Advance Pf Can Be Withdrawn Youtube

Epf Withdrawal Rules Here S How To Buy Your Dream Home With The Help Of Pf

6 Reasons For Which You Can Withdraw Money From Your Epf Account

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

Epfo File Epf Withdrawal Claim Under Covid 19 Category Facebook

Epf Withdrawal Rules 2022 All You Need To Know

Epf Withdrawal Rules Here S How To Buy Your Dream Home With The Help Of Pf

How To Withdraw Epf For House Construction In Just 5 Minutes Youtube

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

How To Withdraw Epf Online Eligibility Status Check

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

Pf Money Withdrawal Step By Step Guide To Do It Online Provident News India Tv